Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhang_web3)

"Black Monday" has struck again.

OKX market data shows that in the early hours of January 26th, BTC dropped from $88,945 to a low of $86,090, a maximum decline of 3.21%; ETH also fell from $2,942 to $2,786, a maximum drop of 5.3%; SOL dropped from $126.99 to $117.16, a maximum decline of 7.74%. As of the evening of the 26th, the market saw a slight rebound, with BTC temporarily reported at $88,200, ETH at $2,915, and SOL at $123.

In stark contrast to the gloom enveloping the crypto market, gold and silver prices have repeatedly hit new all-time highs recently. COMEX data shows that the international silver price reached a high of 109.560 dollars per ounce within 24 hours, with an intraday gain of 8.03%; international gold also strengthened simultaneously, rising to 5059.7 dollars per ounce, up 1.65% on the day. Additionally, the Japanese Yen showed strength in the foreign exchange market. Data shows that USD/JPY touched 154, hitting a new low since November of last year, with an intraday decline of 1.11%.

On social media, the phrase "Anything But Crypto" succinctly captures the frustration of crypto investors.

Trigger 1: Volatility in the Yen Forex Market

Today, the Japanese Yen experienced a wave of intense volatility in the foreign exchange market, with the USD/JPY rate sharply rising from 158.4 to 153.9 at one point, a gain of over 4 yen. Behind this move, the widespread market speculation is that Japan and the US may have begun joint intervention in the exchange rate, or at least engaged in "rate checking," a precursor to foreign exchange intervention.

The sharp volatility in the Yen's exchange rate did not come out of nowhere. As early as January 23rd, the USD/JPY rate in the Tokyo forex market saw a short-term significant appreciation.

The Federal Reserve's rare move to conduct "rate checking" is seen as a preparatory stage for FX intervention, signaling the US government's high level of concern regarding Yen depreciation. According to a Xinhua News Agency report, rate checking typically occurs in the preliminary stage of exchange rate intervention. It is an action where monetary authorities, through the central bank, ask banks about the current exchange rate and market conditions, representing a more direct market operation signal than verbal intervention.

In fact, since 1996, the US has only intervened in the foreign exchange market on three separate occasions, the last time being in 2011 after the Great East Japan Earthquake, when it sold Yen in conjunction with G7 countries to stabilize the market. Precisely because of this, the market interprets this sharp move in the Yen as a potential signal of joint intervention by Japan and the US, an emergency response likely aimed at the Yen's sharp decline. For the crypto market, this means market liquidity and risk sentiment could be significantly impacted, especially as global macroeconomic uncertainties intensify.

Why Would a Stronger Yen Worsen Bitcoin's Decline?

For a long time, Japan's low-interest-rate policy has attracted global investors to the carry trade of borrowing Yen and converting it into higher-yielding assets. This so-called "Yen carry trade" has been a major component of global market liquidity. Carry traders borrow low-interest Yen and convert it into US dollars or other high-yield assets to invest in risk assets like Bitcoin and stocks. However, when the Yen exchange rate appreciates sharply, carry traders typically face pressure from rising funding costs, forcing them to unwind their positions and sell Bitcoin to repay their debts.

Take August 2024 as an example. The Yen surged sharply due to the Bank of Japan's unexpected rate hike and market expectations for FX intervention. This triggered a collapse in carry trades, causing Bitcoin to plummet from $65,000 to $50,000 in just a few days.

Now, with the Yen's exchange rate sharply appreciating again, similar carry trades in the market may once again be forced to unwind, further exacerbating Bitcoin's price volatility.

Furthermore, those familiar with global financial markets know that the Yen is not just Japan's currency; it is also seen as a barometer of global economic risk. Whenever global market uncertainties intensify, funds often flow into the Yen as a "safe-haven currency." This phenomenon is particularly evident during periods of global economic crisis or financial turmoil. However, the Yen's exchange rate fluctuations reflect not only the health of the Japanese economy but also changes in global risk sentiment.

This is why frequent fluctuations in the Yen's exchange rate, especially when global macroeconomics face uncertainty, can directly impact the prices of risk assets like Bitcoin. When the Yen's exchange rate is volatile and intensifying, global market risk aversion heats up, risk assets (including Bitcoin) often experience corrections, while safe-haven assets like gold and silver may see gains. Particularly against the backdrop of potential joint FX intervention by the US and Japan, a short-term correction in Bitcoin's price has become an inevitable market reaction.

It is worth noting that the negative correlation between Bitcoin and the US Dollar Index (DXY) is particularly significant. When the US dollar strengthens, investors tend to shift funds into dollar-denominated assets, reducing demand for high-risk assets like Bitcoin, putting downward pressure on Bitcoin. Conversely, when the US dollar weakens, Bitcoin may find support for gains. If this intervention is successful and causes the USD/JPY rate to fall significantly, the US Dollar Index would be suppressed, providing upward momentum for Bitcoin, which is primarily dollar-denominated.

However, looking at it dialectically, while exchange rate intervention might push Bitcoin's price higher in the short term, if the intervention does not change the market's fundamentals, the price increase is often difficult to sustain. Past FX intervention events show that government intervention is only temporary; changes in market trends rely more on the fundamentals of the global economy.

Trigger 2: Increased Probability of US Government Shutdown, Crypto Market Structure Bill Potentially Stalled Again

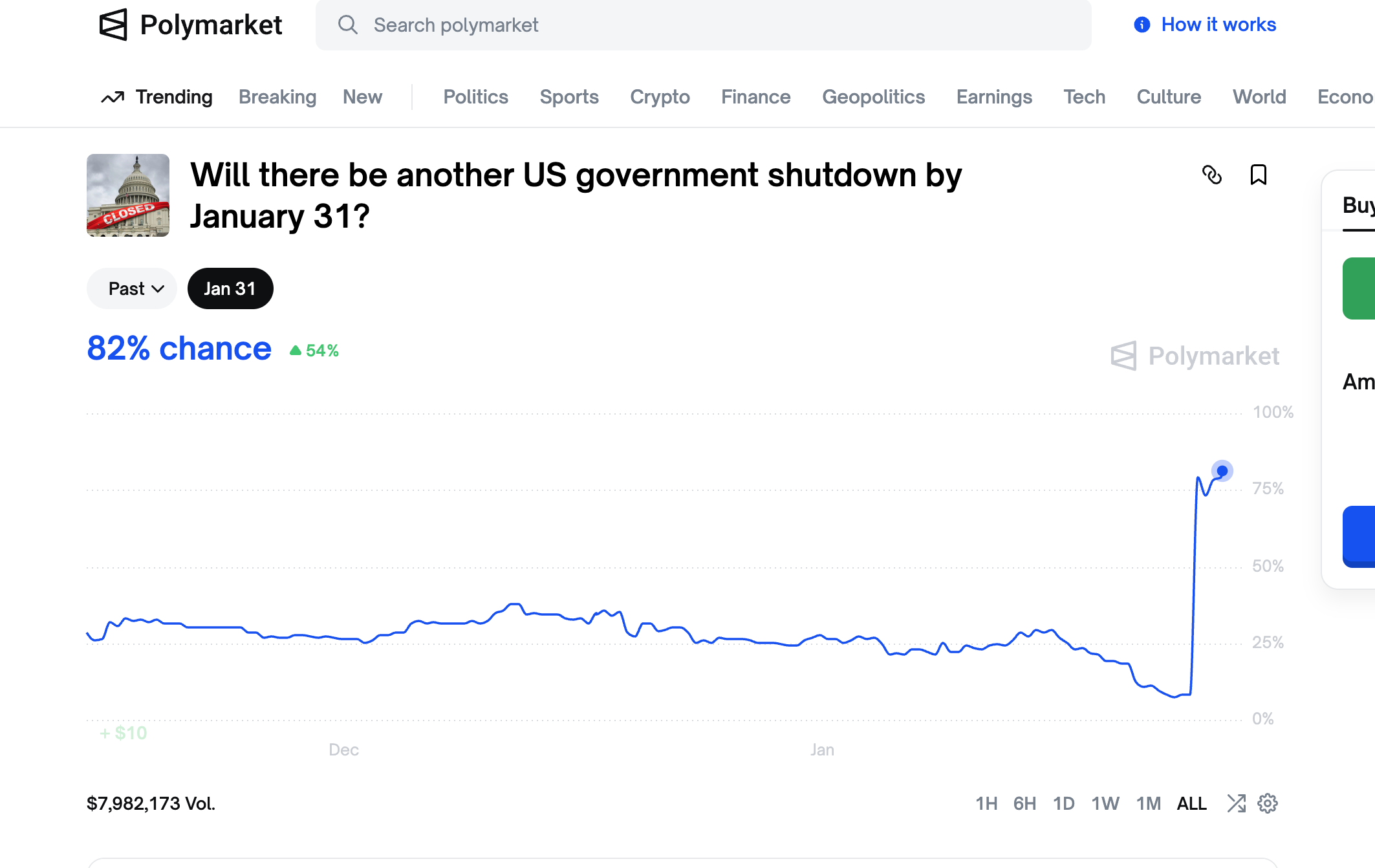

Following another deadly law enforcement shooting in Minnesota, the risk of a US government shutdown has sharply increased. According to the latest data from Polymarket, market predictions for a government shutdown have surged to 82%.

This situation was triggered by a fatal shooting incident in Minneapolis on January 24th. Alex Pretti, a 37-year-old emergency room nurse, was killed during a confrontation with federal law enforcement officers. After the incident, federal and local law enforcement agencies provided conflicting accounts of what happened. The shooting itself sparked widespread public anger and quickly became a trigger for political gamesmanship.

Democratic leader Chuck Schumer clearly stated that if the controversy surrounding the Department of Homeland Security's (DHS) law enforcement actions is not resolved, the Democrats will do everything they can to block the progress of the budget bill. Since the Senate requires 60 votes to pass the bill, this political deadlock will directly impact government operations. It is worth noting that just two months after the last 43-day government shutdown, the government has once again fallen into a shutdown "deadlock."

This political impasse not only means the US government faces the threat of a shutdown but also delivers a direct blow to the regulatory process of the crypto industry. The review meeting for the crypto market structure bill, originally scheduled for January, had to be delayed due to controversy. However, the intensification of this political battle means the bill, which should have continued to advance, may once again be stuck in a stalemate.

Although consensus seems to have been largely reached on the "market structure" part of the crypto market, disputes surrounding issues like stablecoin yields, DeFi compliance, and the regulatory tools for tokenized securities under the SEC's purview present significant political obstacles to the bill's progress.

As Alex Thorn, Head of Research at Galaxy Digital, pointed out, this delay highlights deep-seated disagreements between Congress and the crypto industry on several key issues, particularly regarding stablecoin yield mechanisms and DeFi-related clauses. Alex Thorn further mentioned that within just 48 hours, over 100 amendments were submitted, with stakeholders continuously discovering new points of contention until the last moment, significantly increasing the difficulty of political coordination. For the crypto market, policy uncertainty exacerbates market volatility, and a government shutdown means unpredictable regulatory policies in the short term, filling investors with a sense of uncertainty and anxiety about the future.(Recommended reading:"CLARITY Review Suddenly Postponed, Why Are the Industry Divisions So Severe?")

Conclusion

In this macro game, gold has reasserted its market dominance with a "retro" stance. As the international gold price broke through $5,000 for the first time, the flow of safe-haven funds is already evident. Bitcoin, once hailed as "digital gold," has instead turned in a dismal performance during this systemic shock—for the first time since October 2023, long-term holders (LTH) are "cutting losses" and exiting the market on a large scale while in a loss-making state. This is not just a price collapse; it is a collapse of trust in Bitcoin's ability to withstand a real financial crisis. The market at this moment is choosing not innovation, but stable safe-haven assets, as evidenced by gold's surge.

All this reveals a harsh reality: in the shadow of a financial crisis, the market tends to choose "stability" over "narrative." Gold, as a safe-haven asset, has solidified its position as a harbor in the storm of sovereign credit crises, while Bitcoin's weakness exposes its still fragile foundation of trust within the mainstream financial system. The million-dollar bet on Polymarket—"Gold or ETH to $5,000 first"—has been settled. Gold's complete victory not only marks a decisive price breakthrough but also symbolizes a "return to traditional aesthetics" for the market.

Although traditional assets are regaining dominance, emerging assets are still groping in the fog for the market's true trust. However, market movements are not without opportunity. The crypto market, which has broken the "four-year cycle" rule, still harbors opportunities for buying the dip.

As Placeholder VC partner Chris Burniske said, from a buyer's perspective, BTC price levels worth watching include: around $80,000 (the November 2025 low, the阶段性低点 of this cycle); around $74,000 (the April 2025 low, formed during the tariff panic); around $70,000 (near the 2021 bull market high); around $58,000 (near the 200-week moving average); and $50,000 and below (the lower edge of the weekly range, possessing strong psychological significance; a break below could spark "Bitcoin is dead" discussions).